Turn to our experts to navigate the insurance complexities of the cannabis industry.

Cannabis Dispensaries Program

Specific solutions for a complex industry.

With the everchanging rules and regulations around cannabis, you need an insurance partner who can help you navigate the risks in this dynamic industry. Breckenridge Insurance can tailor a coverage solution that fits a range of businesses serving this space, including those who sell, grow, manufacture or process products containing greater than 0.3% THC. With an AM Best A+ Rated carrier and the sound approach of experienced underwriting professionals, let us help you access fitting protection for this emerging industry.

Retail Agents: Don’t see a fit for your risk in this program?

Reach out to one of our Breckenridge brokers here.

- AM Best A+ Rated carrier

- Industry knowledge

- Responsive team

- Reliable claims handling

- Retailers/dispensaries with or without on-premises consumption

- Cultivators/growers

- Processors/manufacturers

- Wholesalers/distributors

- Medicinal

- Recreational

- Cannabis paraphernalia and related products

Excluded Classes:

- Temporary events

- Testing labs (considered for professional liability)

- Social clubs

- Maximum limits of $5M/$5M/$5M

- Maximum per location general aggregate limit of $5M

- Minimum premium of $5,000

- Minimum deductible of $2,500

- Coverage for electronic vapes

- Budtender Professional Liability

- Hired non-owned auto coverage available

- Commercial general liability

- Premises liability(occurrence or claims-made)

- Products/completed operations liability (claims-made only, including prior acts)

- Commercial property

- Building coverage, business personal property (excluding outdoor plants), and business income

- Claims-made

- Property and Inland Marine

- Workers’ Comp coverage available in certain states

- Equipment breakdown coverage available

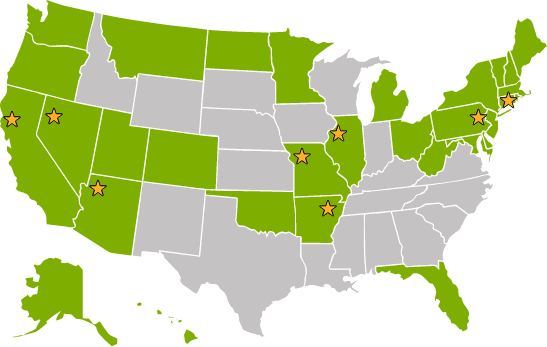

- Product Liability available in the following states – AZ, AK, OR, WA, CO, OK, NV, NM, MD AR, AK, MO, PA, MI & MT

- Cannabis Property Coverage – Provides coverage for cannabis stock, including a valuation clause for plants based on the different development stages of a plant. We allow for limited growing operations as part of the dispensary, subject to state regulations and license requirements

- Cannabis Liability Coverage – Proprietary coverage form addressing cannabis liability exposures, exclusions, warranties etc. Coverage follows the occurrence limit of the policy

- Products Completed Operations can be Occurrence or Claims-made

- Completed application

- Loss runs 3-5 years

- For added coverage options, additional forms may apply

- For prior acts coverage: copy of the current/expiring declarations page (with retroactive date required) and signed proprietary letter (no known incidents for claims-made products liability)

- Startups are eligible with certain considerations

Features

- AM Best A+ Rated carrier

- Industry knowledge

- Responsive team

- Reliable claims handling

Classes

- Retailers/dispensaries with or without on-premises consumption

- Cultivators/growers

- Processors/manufacturers

- Wholesalers/distributors

- Medicinal

- Recreational

- Cannabis paraphernalia and related products

Excluded Classes:

- Temporary events

- Testing labs (considered for professional liability)

- Social clubs

Coverages

- Maximum limits of $5M/$5M/$5M

- Maximum per location general aggregate limit of $5M

- Minimum premium of $5,000

- Minimum deductible of $2,500

- Coverage for electronic vapes

- Budtender Professional Liability

- Hired non-owned auto coverage available

- Commercial general liability

- Premises liability(occurrence or claims-made)

- Products/completed operations liability (claims-made only, including prior acts)

- Commercial property

- Building coverage, business personal property (excluding outdoor plants), and business income

- Claims-made

- Property and Inland Marine

- Workers’ Comp coverage available in certain states

- Equipment breakdown coverage available

- Product Liability available in the following states – AZ, AK, OR, WA, CO, OK, NV, NM, MD AR, AK, MO, PA, MI & MT

- Cannabis Property Coverage – Provides coverage for cannabis stock, including a valuation clause for plants based on the different development stages of a plant. We allow for limited growing operations as part of the dispensary, subject to state regulations and license requirements

- Cannabis Liability Coverage – Proprietary coverage form addressing cannabis liability exposures, exclusions, warranties etc. Coverage follows the occurrence limit of the policy

- Products Completed Operations can be Occurrence or Claims-made

Submission Criteria

- Completed application

- Loss runs 3-5 years

- For added coverage options, additional forms may apply

- For prior acts coverage: copy of the current/expiring declarations page (with retroactive date required) and signed proprietary letter (no known incidents for claims-made products liability)

- Startups are eligible with certain considerations

Contact

Alyssa Manders, CIC, CPL

Assistant Vice President, Underwriter

Madison, WI

Cannabis, CBD, and Vape Shops

Office: (312) 521-8969

“Again, I want to thank you for all your help! I really do appreciate it. I don’t think there are many companies out there who would be willing to work with us as much as you did!!”

Insurance Agency Office Manager

Cannabis Dispensaries was last modified: March 20th, 2025 by